Small businesses migrate online to keep ventures afloat

One in seven small business owners say they are transitioning towards becoming fully or mainly online enterprises since the outbreak of the COVID-19 in the UK, according to new research from Hitachi Capital Business Finance

The findings come at a time when Facebook has announced the launch of Facebook Shops, which gives small businesses that have suffered amid the pandemic the tools to create online stores on Facebook and Instagram. The new Hitachi Capital Business Finance data suggests the proportion of small businesses that are offering services fully online, has increased by more than 50 per cent since the period of isolation began – rising from 24 per cent to 38 per cent.

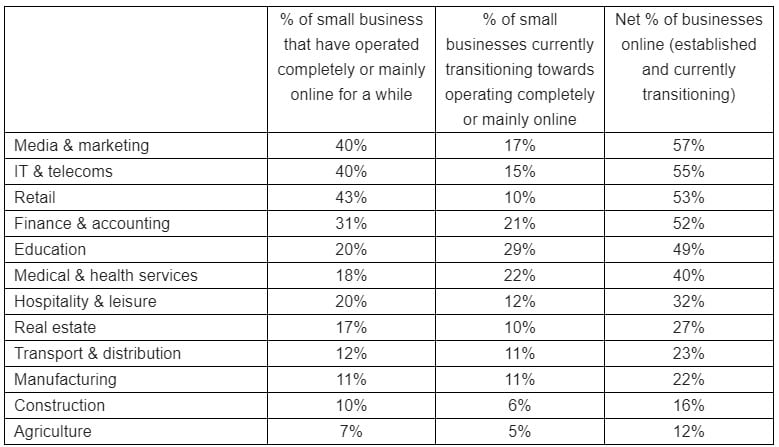

The sectors where small businesses were most set up for online operations before the pandemic struck were retail (43 per cent), IT and telecoms (40 per cent) and media (40 per cent). In the last two months, the sectors where small business owners have been most urgently transitioning their ventures to online platforms have been education (29 per cent), medical (22 per cent) and finance and accounting (21 per cent).

The net result is different industry sectors are set to emerge from the lockdown period as the most digitally enabled. Further, the research suggests the pandemic may see a widening of the tech gap between small businesses – with the gap between the most and least digitally-enabled sectors widening from 33 per cent to 45 per cent in a matter of months.

By region, the research reveals that the East of England (33 per cent) and Scotland (29 per cent) have now overtaken London as the regions that now have the highest proportion of small businesses online. London (21 per cent), the South West (15 per cent) and Wales (15 per cent) are the regions where small business owners are working the hardest to transition their businesses onto a fully online enterprise.

Gavin Wraith-Carter, managing director at Hitachi Capital Business Finance said: “In recent years, online and digital capabilities have been seen as desirable goals for many small business owners – for others, a consideration for the future. The shock of the COVID-19 pandemic has changed things overnight. Today, online capabilities are essential, many small businesses need them simply to operate and to stay open for business.

“Our own research has revealed that offline businesses where more than twice as likely as online businesses to have had to close their doors since the pandemic struck the UK (39 per cent versus 17 per cent). Furthermore, the online status of a small business in the current climate correlates with growth outlook for the months ahead. For example, 72 per cent of the businesses that predicted significant expansion in the next three months were online businesses. In contrast, 71 per cent of the small businesses that predicted they would struggle to survive were offline businesses.

“These are stark findings. At Hitachi Capital Business Finance we are investing heavily in our digital channels to support small businesses at a critical time and we expect to see a lot of small business investment and borrowing being directed in enhancing their online capabilities in the second half of the year.”

-

50 franchise brands with training programmes in 2025

Updated one year ago -

Turn the Budget into business wins – your 2026 strategy starts now

Updated one month ago -

Johnny Pearce: “Sustainability isn’t just a trend – it’s a growth strategy”

Updated 8 months ago -

Franchise funding: How to beat the banks

Updated about 9 months ago -

Franchise agreements: How to navigate territory rights

Updated 9 months ago -

Why choosing the right shipping partner matters

Updated 11 months ago -

How to get Brits making and sticking to new year business goals

Updated one year ago -

How a two-day trip to head office sets Blossom franchisees up for success

Updated one year ago -

92 Degrees celebrates 10 ‘Damn Fine’ years as a business

Updated one year ago